The forty year history of e-commerce has been a story of impressive growth – and this trend is more than likely to continue. In 2016 e-commerce in Europe is expected to generate app. EUR 509.9 bln of online sales of goods and services. According to the European B2C E-commerce report by Ecommerce in Europe, this figure will signify growth of 12 pct y-o-y, slightly less than the 13.3 pct growth of 2015. This surge in online sales is way above the growth of general retail in Europe, which in 2015 came to just 1 pct. “According to the various reports that have been published, the e-commerce segment is growing at a rate of 12 pct to 15 pct per year. This very positive trend should continue for at least a couple of years,” says Robert Pawłowski, a senior industrial and logistics negotiator at CBRE.

Direct leases the majority

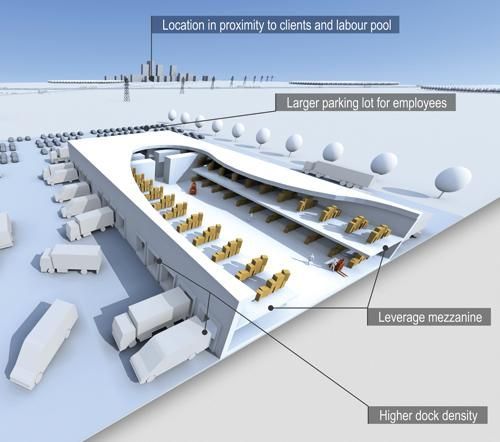

How is this exponential growth affecting the industrial property market? Prologis’ research includes a detailed lease-by-lease review to quant