The 17th Expo Real International Trade Fair for Property and Investment in Munich

The smell of money, to put it grandiloquently, was in the air in Munich, where the crème de la crème of the European real estate market was gathered at the beginning of October. It is scary to think that the atmosphere bore a marked resemblance the years to 2006–2007.

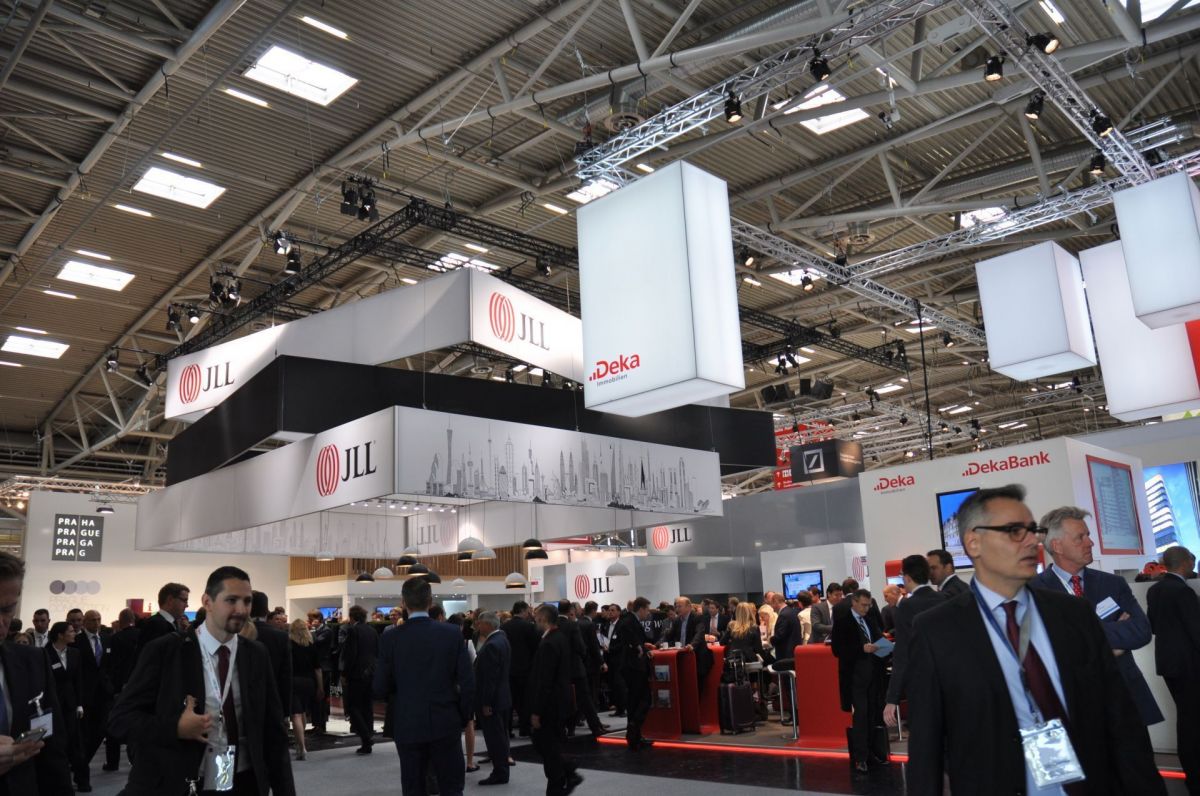

Germany, UK, Holland, Austria, Switzerland, France, Poland, the Czech Republic, the United States, Russia and Luxembourg were the ten countries represented by the most participants, according to a report summarising the fair. The total number of all those attending amounted to 36,900, slightly more than in the previous year (36,000). “Expo this year had a strong attendance and was positive in the message it sent out about the real estate investment market. Poland’s top spot status for international investors in this part of Europe was confirmed – and it was revealed that all the activity across the sectors has even pushed prices up. Large international fund platforms are receiving significant inflows of capital and Poland should attract a large portion of this money. We have new players who are in particular screening retail assets in regional cities – and soon these should materialise in the closing of transactions,” said Tomek Buras, the managing director and head of Poland for Savills. “International investors are typically interested in core properties, nevertheless we have observed an ever-growing demand for value-add assets in Poland. Also, the interest in portfolios is growing, particularly for those offering some value-add potential. Therefore, value preservation on the one hand and value creation on the other seem to be most important strategies and should be seen as the buzzwords of this year’s Expo Real,” added Michał Ćwikliński, the managing director and head of investment department at Savills.

Office developers who invest in regional towns, such as Hines, which owns the Neptun skyscraper in Gdańsk and the Sterling Business Center in Łódź, have also noted the scale of the interest in investing capital in such products. This is confirmed by Agata Gola, the head of property finance of PKO BP. “The acquisition of capital by investors is not a major problem right now. Its appropriate allocation is a much bigger problem. The limited availability of core assets has resulted in a significant growth of interest in regional markets and value-add or opportunistic assets. The trend should be maintained in the next twelve months. It is expected that 2015 will a record year as far as investment transactions on regional markets in Poland are concerned. The strong competition among banks in terms of financing core products is reflected by increased pressure to lower credit margins. What I can see is a reduced inclination among banks to finance value-add products when returning to the regional markets. Banks are increasingly involved in financing enterprises at the development stage, since these bring a higher return for the invested capital – German mortgage banks are still approaching this area with a few reservations,” believes Agata Gola.

The representative of CBRE points out another blot on the landscape. “Investors and market observers are concerned about the possible growth of a speculative bubble. On the other hand, the good – but not too optimistic – prospects for the Polish economy have bolstered investors’ conviction that shopping in Poland is safe. On the other hand, there is quite a lot of caution when it comes to decision-making, which proves that the market got wiser. In my opinion, maintaining stability depends to a large extent on the policy of banks, which so far were very cautious in terms of financing,” remarked Mikołaj Martynuska, the senior director in the development consultancy department at CBRE.

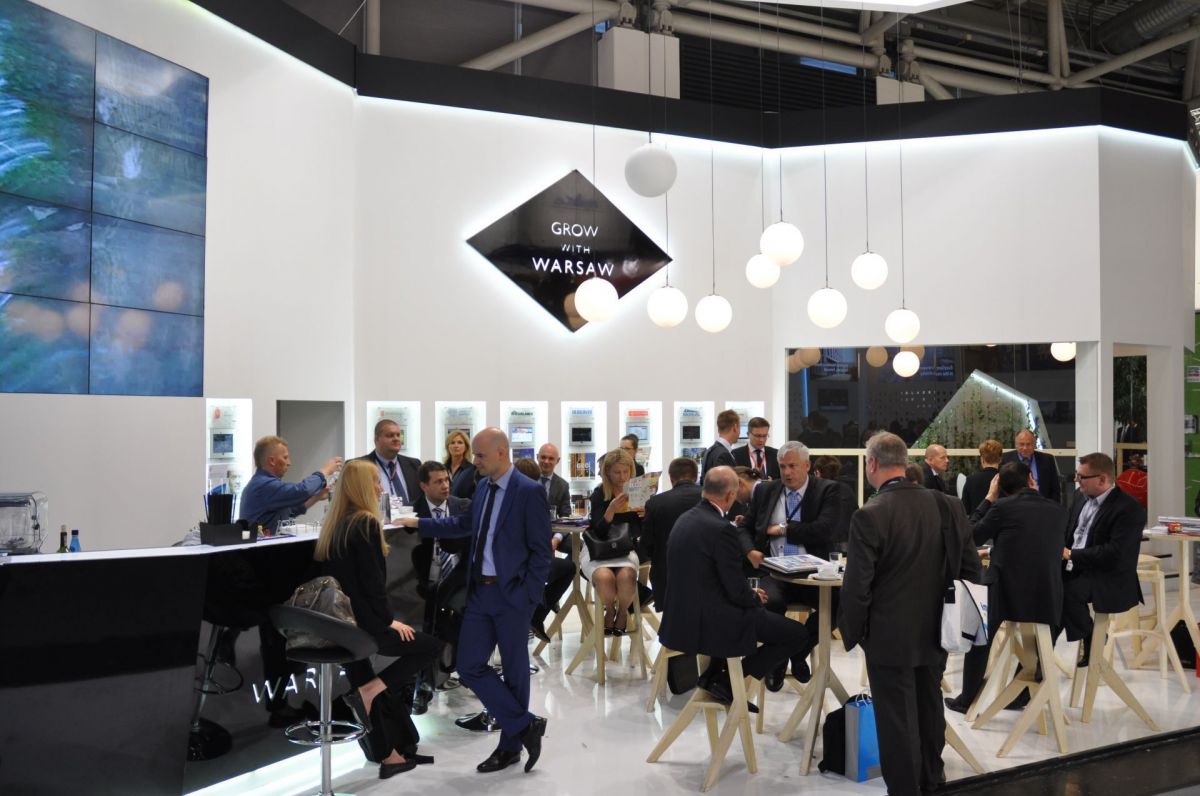

It was not only developers who were present at Munich, but also cities – a fact noted by the developers present. “The very strong contingent of Polish regional cities, the offer of which mainly consisted of investment land. The presentation of the city of Warsaw was also one that should be admired. Its stand, which was prepared together with industrial partners, attracted a large group of visitors every day and, most importantly, riveted the attention of potential investors. The main themes of the fair, which in principle focuses on commercial real estate more, was this year partly dominated by the investment side, which is reflected by the presence of new investors planning to launch their projects in Poland, including Russian and Arab investors,” commented Tomasz Lewandowski, the real estate assets managing director at MS TFI, which came to the fair to present its Nowy Świat 2.0 building, among others. “As representatives of the Mars fund, we came to the fair in order to hold trade negotiations over a few projects. The most significant of these are: the Nowy Świat 2.0 office building in the centre of Warsaw, a mixed-use project including a wharf on ul. Waszyngtona in Gdynia, as well as a number of industrial projects that have direct access to the Baltic Sea, located on Gryfia Island in Szczecin and in the industrial part of Świnoujście,” revealed Jacek Kopczyński, the real estate investment managing director of MS TFI.

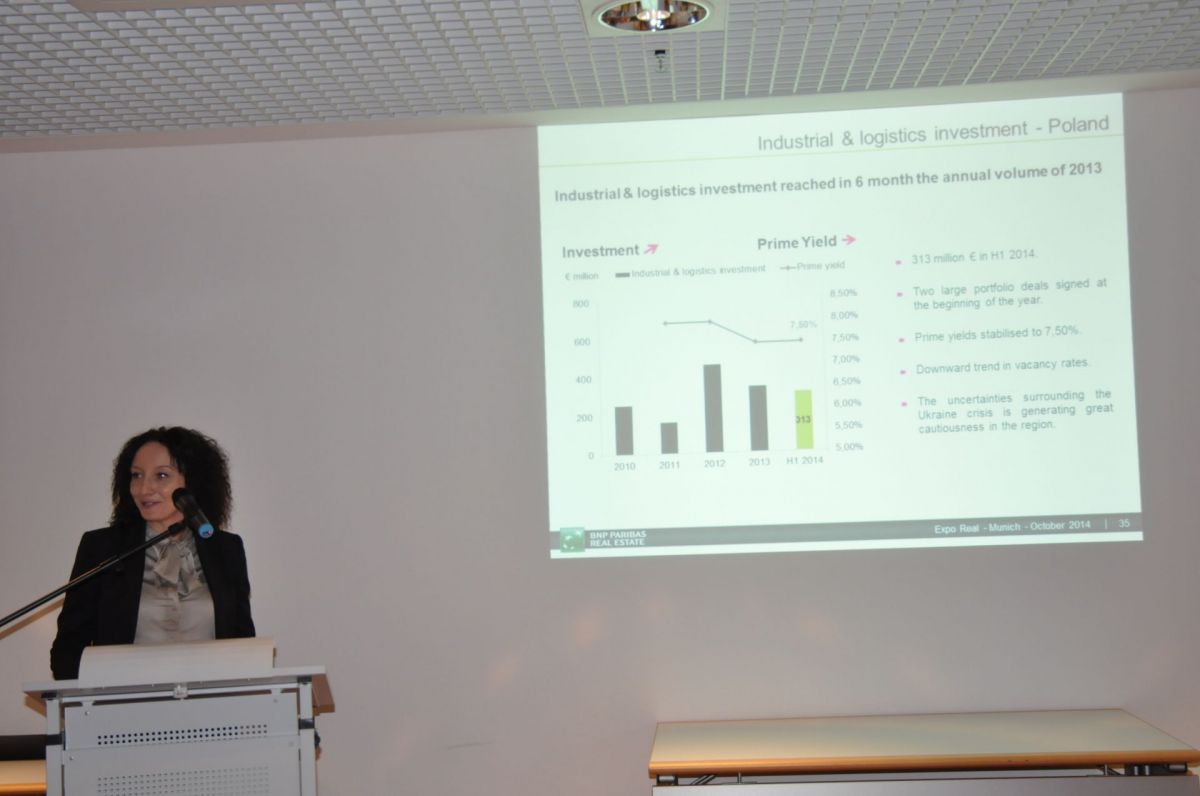

What else were the investors focused on? “For the first time Poland became the leader of the region in terms of the value of investment transactions – over EUR 2 bln after three quarters – constituting app. 40 pct of the total value of the investment market in the CEE region, thus dethroning Russia. There is new capital from North America, the Far East and Australia. Interestingly, the logistics market is experiencing a revival – for the first time it exceeded shopping centres in terms of the percentage share in the transaction volume,” emphasised Piotr Mirowski, a partner and director of CEE investment services for Poland at Colliers International. The interest in the warehouse sector was also remarked on by a representative of P3 Logistic Parks (formerly PointPark Properties), one of exhibitors. “Everyone I talked to stressed that the competitiveness of the Polish market is making international companies increasingly eager to locate their distribution centres in our country. In the automotive industry, it is Romania that is receiving much more attention. The automotive sector is showing strong growth there, new factories continue to be built to supply car manufacturers with parts or components. The main asset of the market are the lower salaries for employees. Meanwhile, from our point of view, this year’s fair was particularly important because we officially came as P3 Logistic Parks for the first time,” said Andrzej Wroński, the country head for Poland of P3 Logistic Parks and the head of asset management for Central and Eastern Europe.

And how would a newcomer summarise his trip to Munich? “So far I have not had any opportunity to go as I am not directly involved in real estate investment, but I have had an indirect influence on the shape of the market by representing office tenants in Poland. The funds that shop in Poland and the CEE region are very interested in how tenants see the future, what industries will be developing, what has caused the decline in rents in Warsaw and why regional cities in Poland are developing so well. The overall mood was positive. However, some pessimistic voices could also be heard – some people actually said that the situation resembled 2008, but my personal feeling was that the general mood was one of cautious optimism. Because of the nice weather, the nearby mountains and excursions with clients to climb the highest peak of the German Alps, Zugspitze, as well as the event TK held where excellent wine was served, I am already looking forward to next year,” declared Daniel Bienias, the senior director and head of tenant representation for Poland in the office department at CBRE.