The Akron Investment Central Eastern Europe investment fund, managed by Akron Group of Vienna was established in December last year. Fund investors, everyone who is able to disburse a minimum 200,000 euro, decided to designate 250 million euro for real estate investments in Poland, Czech Republic and Hungary. Between 80 and 100 million euro of that sum will be invested in Poland, with all capital to be spent within two years.

Transaction worth emulating

In late February Akron mentioned the purchases it had made in Poland - two office buildings (Bokserska and Cybernetyki Office Centre) and

a warehouse project (Bokserska Distribution Park) bought from Ghelamco Group for

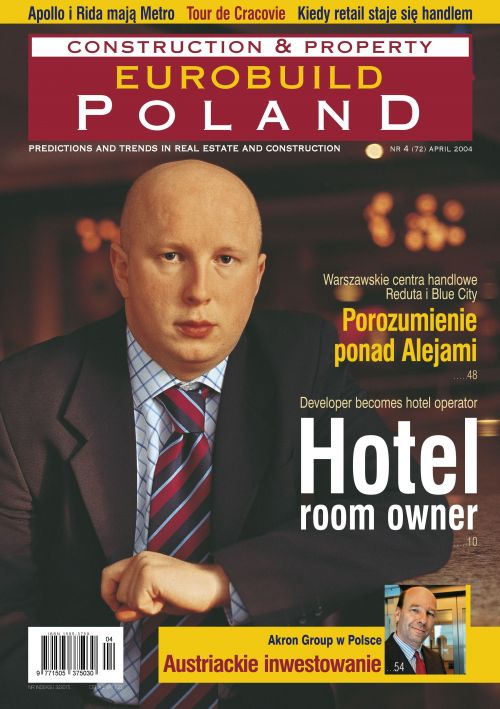

45 million euro. This transaction with Ghelamco highlights exactly the properties in which we are interested, remarks Stefan Ausch, Akron Group Executive Director responsible for operations in this part of Europe, adding that the Group wishes to focus on office buildings and warehouses.