The necessity to regulate development activities by way of enactment confirms the lack of protection of rights of those who buy apartments or houses. In agreements on building of residential premises, the law does not favour the purchasers. It also does not protect them from the risk of bankruptcy of development companies or building societies.

Agreement full of data

The Bill on protection of the purchaser in development contracts refers to undertakings being implemented by developers and building societies, provided they build residential premises on the basis of separate premises ownership.

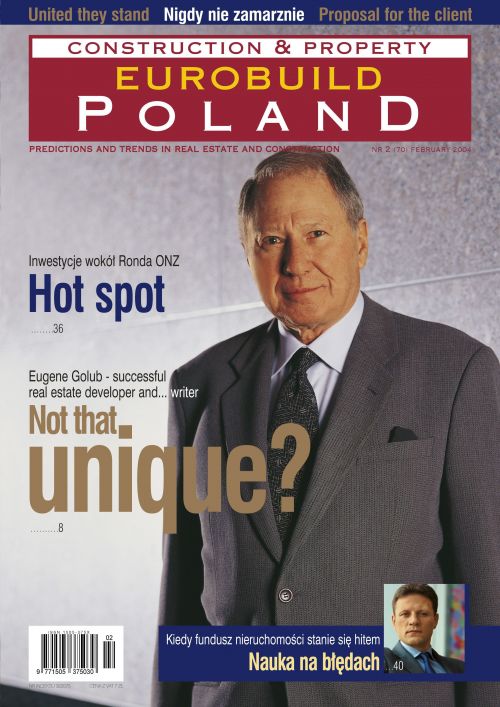

The prepared Bill prescribes what kind of information regarding the investment should be included in the respective provisions of a development contract. As a result, not only the basic parameters of the project (among others information on the plot, where it is being realized, relevant features of the building), but also the date of title transfer of the premises to t