Prices won't skyrocket in Poland long-term, says Richard Petersen,

Managing Partner of newly re-named Cushman & Wakefield Healey & Baker,

but invested sensibly, you won't lose money in this market either.

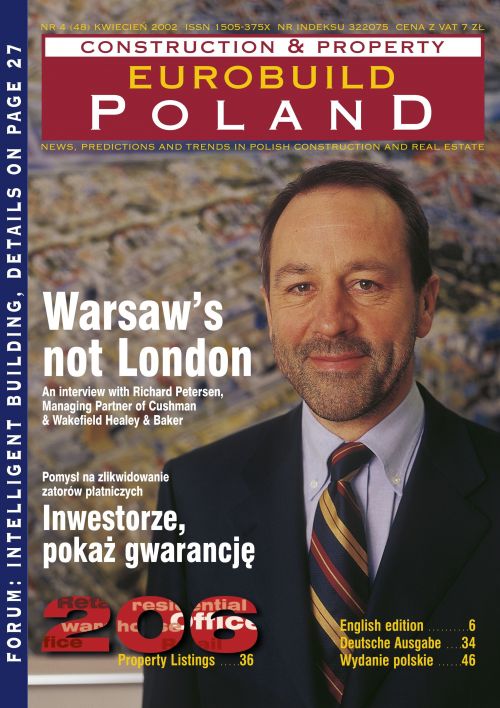

Richard Petersen is one of the Warsaw property market's more enigmatic

figures. He is also the longest serving of the international real estate

consultancy bosses. Arriving in Warsaw in 1991 he established 'Property

Services International' in co-operation with Healey & Baker, with which

it later merged. Since then Healey & Baker has established itself as one

of the market standard-setters. Asked how he came to be in Poland at the

beginning of last decade, he dissembles. "I don't know if I can think of

an answer to that," he says, before explaining that he sort of drifted

here with the tide. "I didn't want to come in the first place but my

former business partner, Polish architect Ryszard Stepan, persuaded me

to come. Then we started gradually getting hooked in." At firs