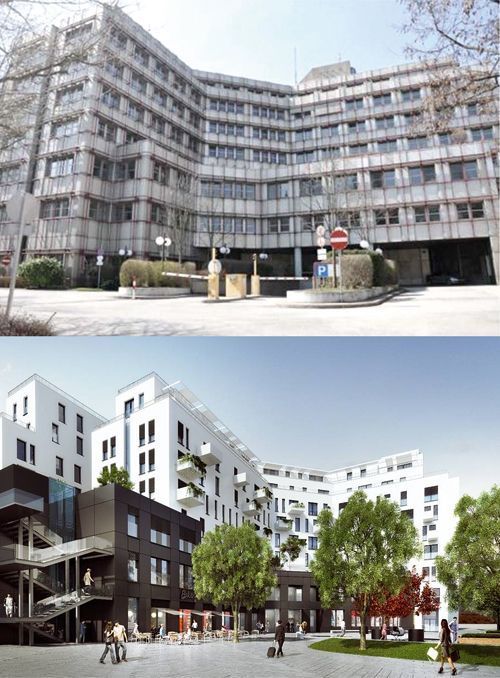

In Western Europe, particularly in the Netherlands and Germany, many examples of successful conversions of old office buildings into luxury apartment buildings or hotels can now be found. In Poland we are also starting to think about such redevelopments projects, due to the growing competition on the office market and the technical condition of old office buildings. Administrative buildings constructed for state companies in the 1960s, 1970s and 1980s were often built in good locations as ‘infills’ between existing buildings. Such buildings can be demolished, but some can be redeveloped. And money can even be earned from this in a quick and relatively inexpensive way. Particularly considering the fact that the architecture of those years, after changes to the façade, can successfully be passed off for a new building – since both architectural styles are mostly based on richly adorned and glazed cuboids.

Polski Holding Nieruchomości has s