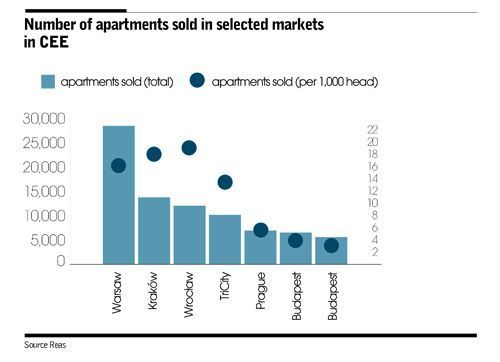

“With the booming Polish economy, rising salaries, low interest rates and the resulting high availability of loans as well as the attractiveness of investing in properties for rent, developers sold 28,000 apartments in Warsaw alone in 2017,” says Paweł Sztejter, the managing partner at REAS. “Sales in Kraków came to almost 14,000 and in Wrocław they came to over 12,000. Such a high number of transactions on the primary residential market is an unprecedented phenomenon throughout Europe. Sales on Polish markets are even five times higher than in other large centres of the region,” he adds.

Poland ahead by miles

In Warsaw, over 16 apartments per 1,000 inhabitants were sold last year, in Kraków this figure was 18 while Wrocław was the most active market with nearly 19 transactions per 1,000 inhabitants on the primary market. In Bucharest, where the population exceeds 2.1 mln, developers sold less than 6,000 housing units in 2016, or less than 3 apartments per 1,000 inhabita