Europolis has proved itself to be one of the foremost real

estate investors in Central and Eastern Europe. It has cash to spare

and special plans for Warsaw.

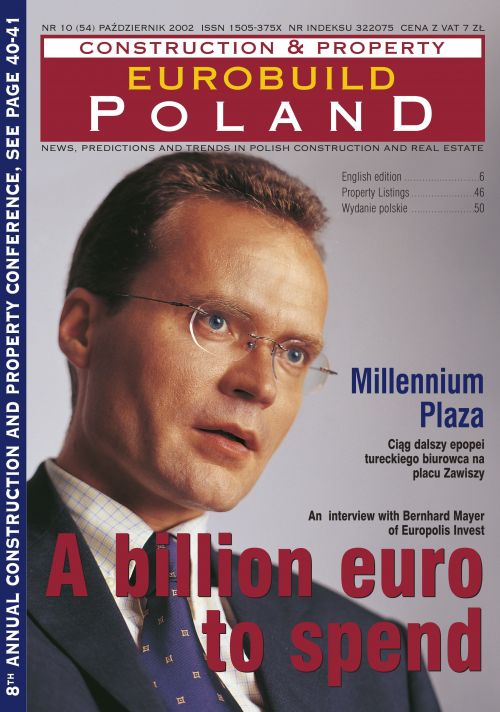

Eurobuild speaks to Director Bernhard Mayer.

In Central Europe you have invested mainly in office

buildings. Two exceptions were warehouse complexes in the Alliance Logistic

Centre near Warsaw. Why is that? Can you explain Europolis Invest's strategy?

- It has a historical basis. In the past, Europolis developed

four office buildings in Vienna, so our staff are experienced in this type

of real estate project. We also think that the office market is more reliable

in terms of location and tenants, whose financial standing is usually better

than in other sectors.

So why did you decide to invest in warehouse projects?

- Because we think the number of products is very limited

in Central Europe. If you come to Warsaw and look at the buildings which

are potentially interesting to invest in, you will end up with perhap