Expo Real 2019: Bigger and better than ever

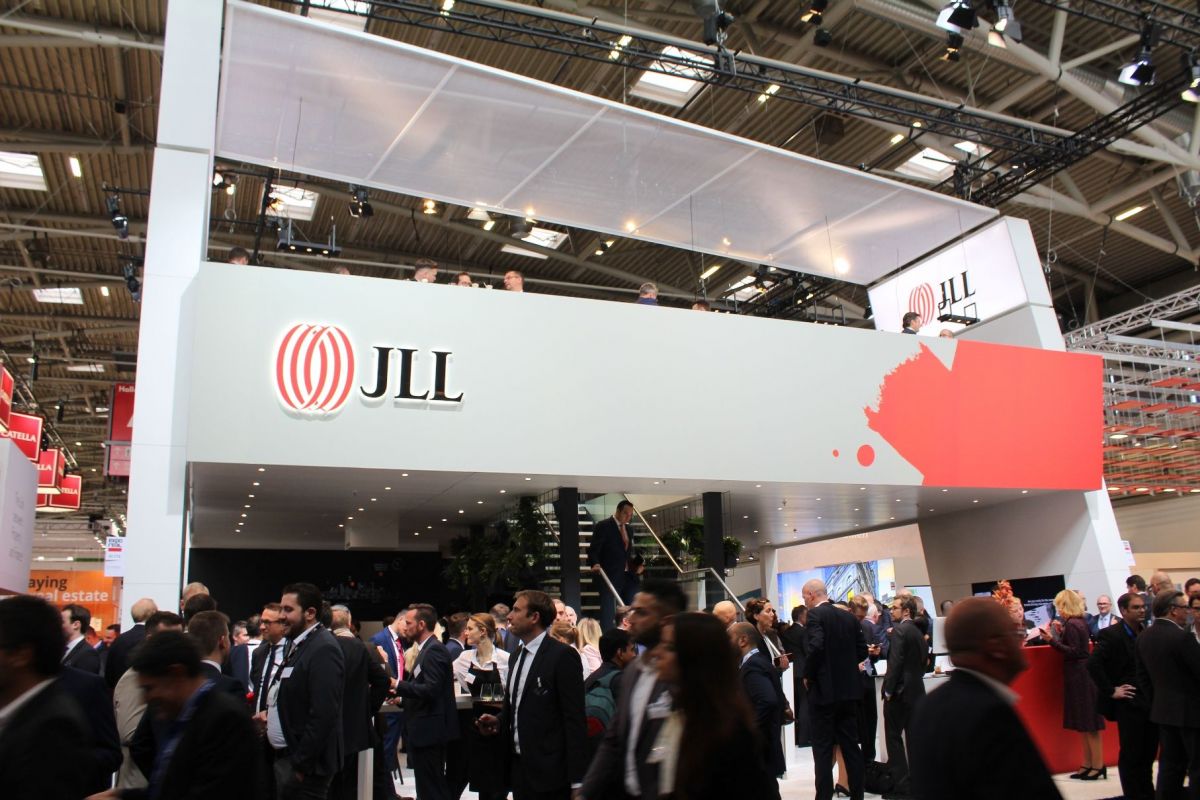

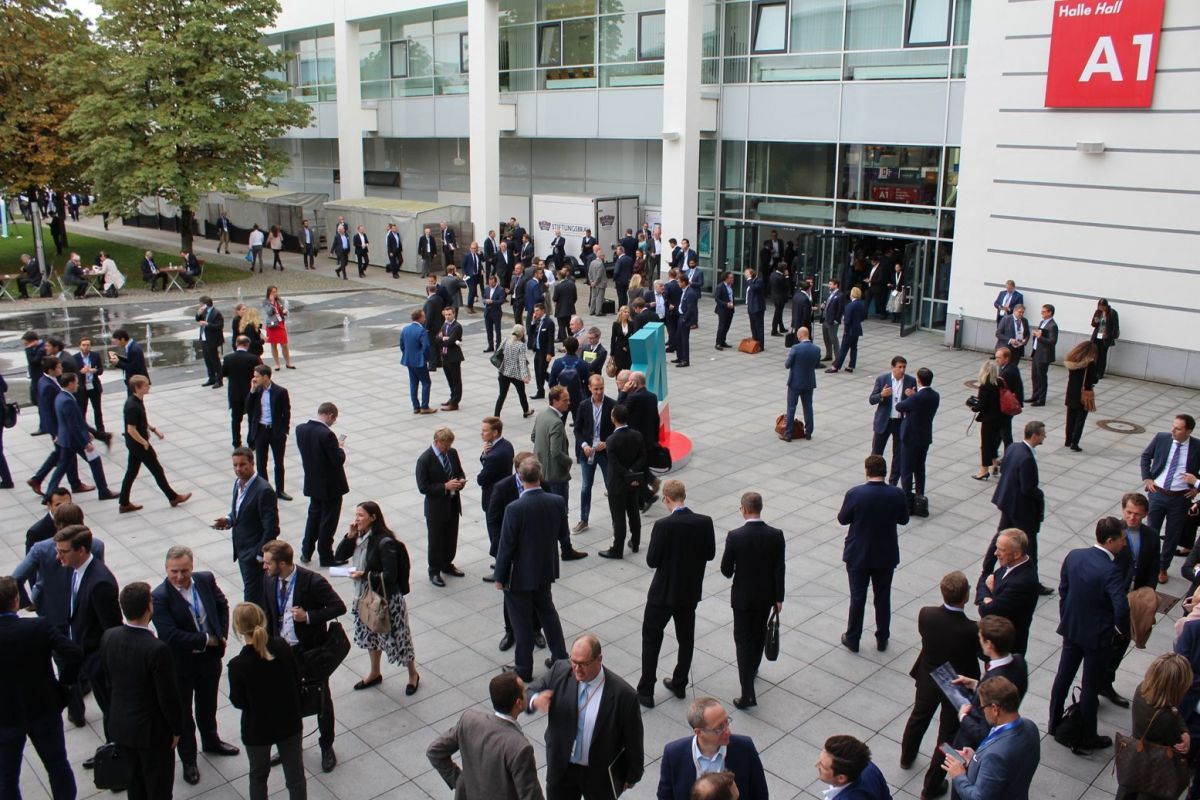

With 2,190 exhibitors from 45 countries and 46,000 visitors from 76 countries an additional hall was needed this year at the Expo Real trade fair held in Munich, the largest such event held so far. There were no signs of the purported slowdown of the German economy at the trade fair, which has now been held every year since 1998. The mood was excellent – really excellent! There was nothing to make you feel like you were dancing on the Titanic, although sometimes...

The real estate market has been booming for a number of years, so it is hard to expect the mood at the largest real estate and investment event in Europe to be sombre. From the first day of the fair, it could be seen that the sector is still teeming with life. “The markets are still optimistic and the fair should be considered a success – there is still a great deal of activity in the sector. Despite reports of a slowdown in Germany, it is difficult to see any effects on the real estate sector for the time being,” said Richard Aboo, the chair of EMEA office agency at Cushman & Wakefield.

Surprisingly enough, the more uncertain the situation, the better the real estate sector market becomes – at least that’s the opinion of Ulrich Kater, the chief economist at Deka Bank. Indeed, he argues that the real estate is one of the few sectors that is actually benefiting from the uncertainty. “In a phase like that, people buy property, so uncertainty coming from the White House or from London is actually helpful to this sector; of course it must not be overdone,” he elaborates. The real estate sector is not even being shaken by Brexit. “It will be the UK that is really hit by the consequences,” he argues.

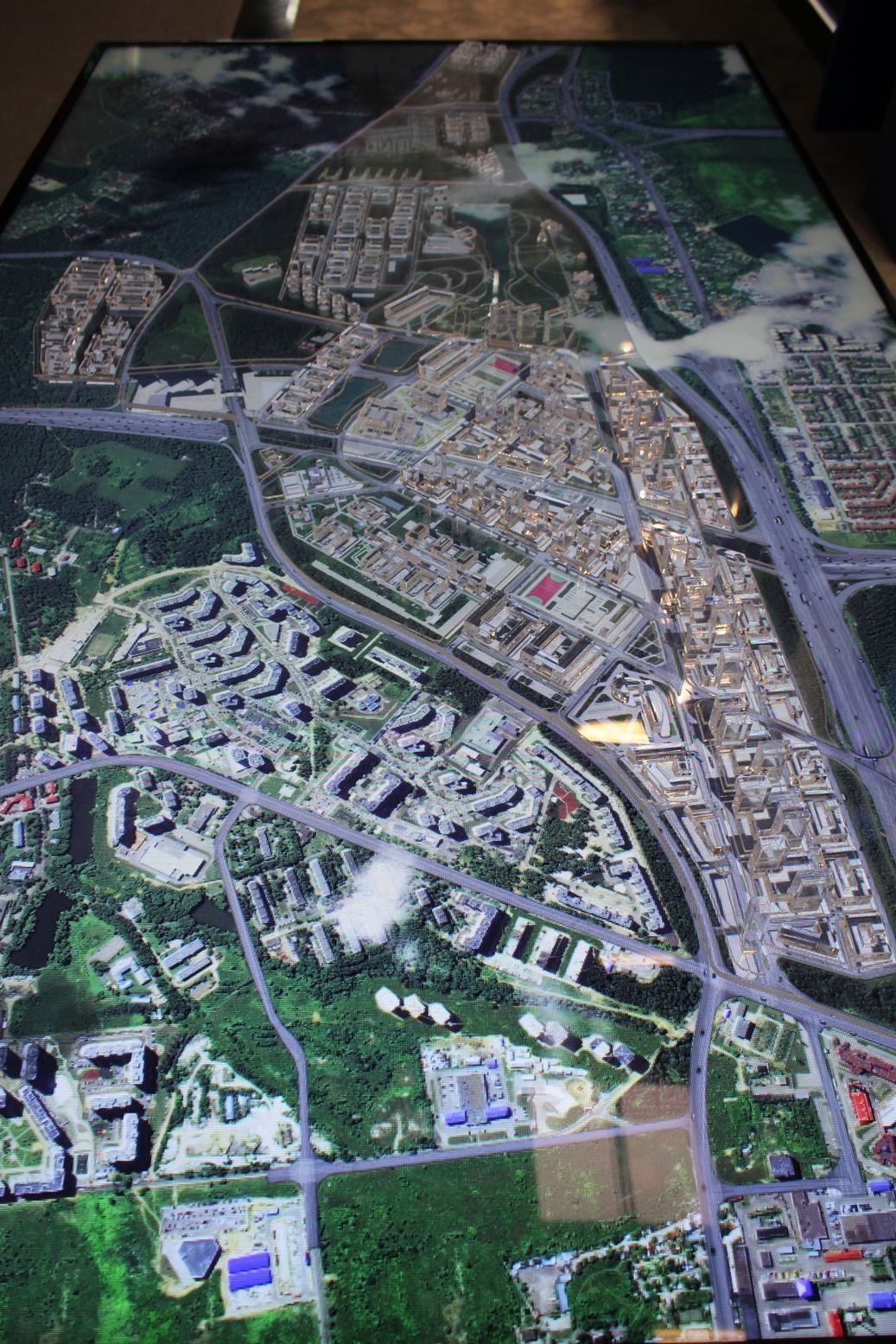

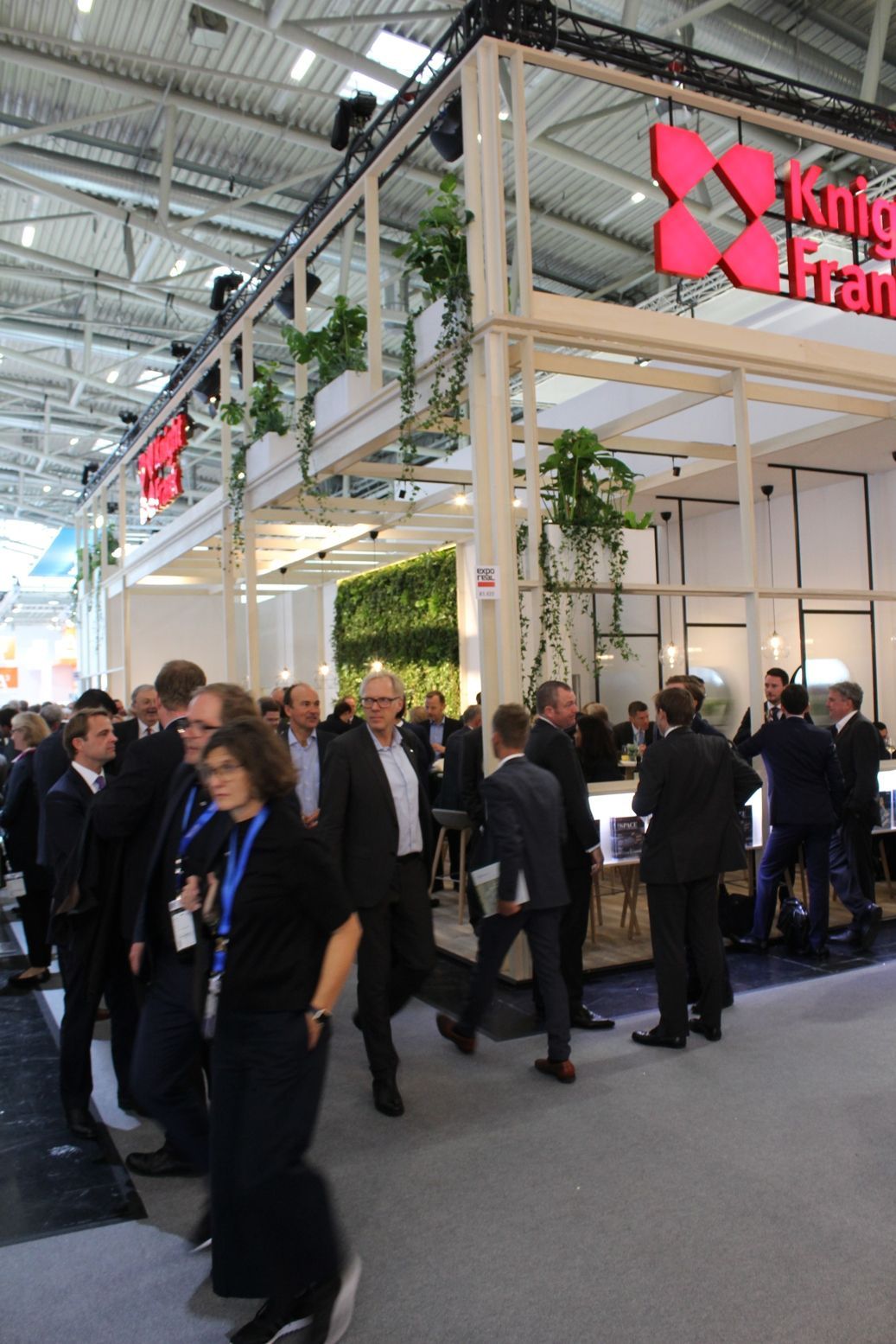

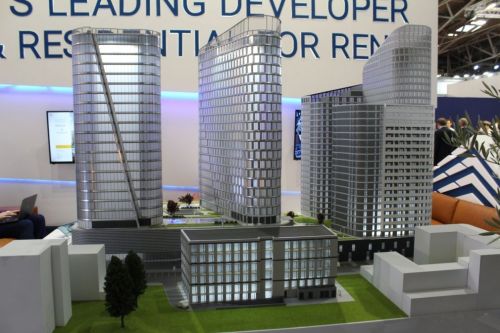

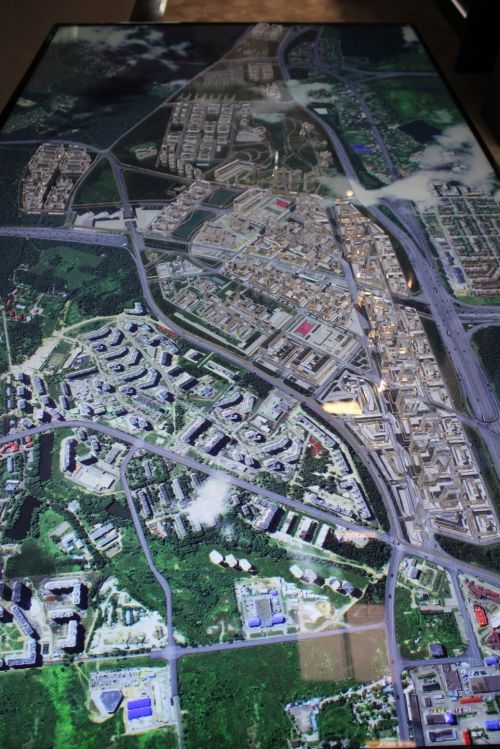

The current market situation also seems to be favourable for Polish real estate, and large numbers of Poles attended the event. According to the organiser, Poland was one of the top five countries to exhibit at the fair. On the first day of the fair, the EUR 230 mln loan to refinance Warsaw Spire Tower was announced. The two banks were Helaba, Berlin Hyp and Pbb Deutsche Pfandbriefbank. Nobody is expecting the river of capital flowing to Poland to dry up tomorrow and indeed many predict the flow is to increase: “After meeting many investors I can say that Poland is still garnering a lot of interest. A great deal of money could soon flow to Poland, far exceeding the value of the real estate that is currently on sale,” claims Daniel Puchalski, the managing partner at Knight Frank. Jeroen van der Toolen, the managing director for the CEE of Ghelamco, is of a similar opinion arguing that Poland is a hot market, which he claims can be seen in the interest of both investors and banks. “What is novel is that the Polish real estate market is becoming more interesting to investors from Asia and this could result in a number of interesting transactions in the near future. The fair itself was a success – a lot of people came, we had a lot of conversations where we got talking about specifics. In a nutshell: We were in the spotlight,” claims Jeroen van der Toolen.

Nicklas Lindberg, the CEO of Echo Investment was also upbeat. He claims investors are looking to invest in Poland as it offers high and stable profits: “The office sector, in Warsaw as well as in the regions, is still hot. There’s also a great deal of money around the world looking for good investments. This leads me to the conclusion that further compression in the office sector is still possible. First of all, I would expect to see this in regional cities where Echo Investment has a high exposure, as well as in Warsaw especially on the outskirts of CBD, where we’ve not seen such a compression as in the CBD yet.”

These observations were echoed by Roman Skowroński, the managing director of Peakside Capital Advisors, who stated: “There was a very positive atmosphere at the fair and definitely fewer people were talking about a potential crisis. Almost all the investors and agents were focusing on further yield compression, which is to break new records. The warehouse and industrial sector is much more popular than retail space, which is not very liquid. Investors love the Polish warehouse market, but of course they are approaching investments selectively.”

Although it was difficult to find anyone at the fair voicing any worries for the future, it might be worthwhile toning down the optimism of this report. Stanislav Frnka, a senior partner at Griffin Real Estate, viewed the fair with some distance, commenting that The mood at the fair seemed very optimistic, a great deal was happening and many meetings were taking place. No one seemed to sense the slowdown of the German economy. However, we should wait and see what the next few quarters will bring. Michał Styś, the CEO of OPG Property Professionals seemed to share a similar point of view: “Real estate is a business that requires time and trust. The mood was good at this year's Expo Real, but it is only the next few months that will show if and to what extent the fair has been a success,” he claims.

Maybe it was the stewardess on the plane back to Warsaw who best summed up the fair for me. I was flying with a German airline and the plane was full of passengers coming back from Real Expo. On landing the woman mistakenly announced: “Welcome to Copenhagen..., oops..., sorry, where are we...? Sorry, welcome to Warsaw.” I agree; the burning question is “Sorry, where are we?”