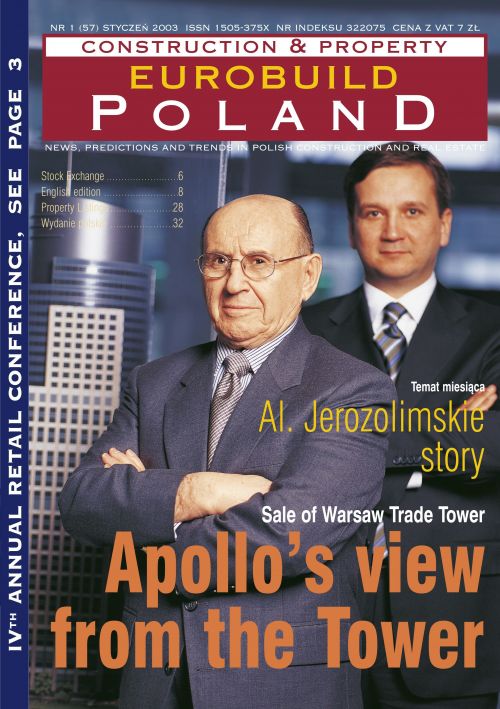

American developer and investor, Apollo-Rida Poland has

decided not to change the name of Warsaw Trade Tower, their new office block.

They are very reticent, however, to talk about any other plans they have for the

building. An Austrian investment fund apparently participated in the recent deal

and in December, one of the banks which had financed the construction of WTT

recouped the funds they'd invested

Apollo-Rida have begun looking for tenants for their building

but, since there are still 20,000 sqm vacant in this 33,000 sqm giant, it

doesn't look as if they're faced with an easy task (by Autumn 2002 tenants were

occupying around 9,000 sqm). How is the company going to tackle this problem?

"We're optimistic" says spokesman Rafał Nowicki. He claims that more

details will be divulged during the next few weeks when negotiations with the

first prospective tenants come to an end. The company actually began talks with

them a few months ago when Dae-Pol was still the owner of